Housing Market Trends

Market Outlook

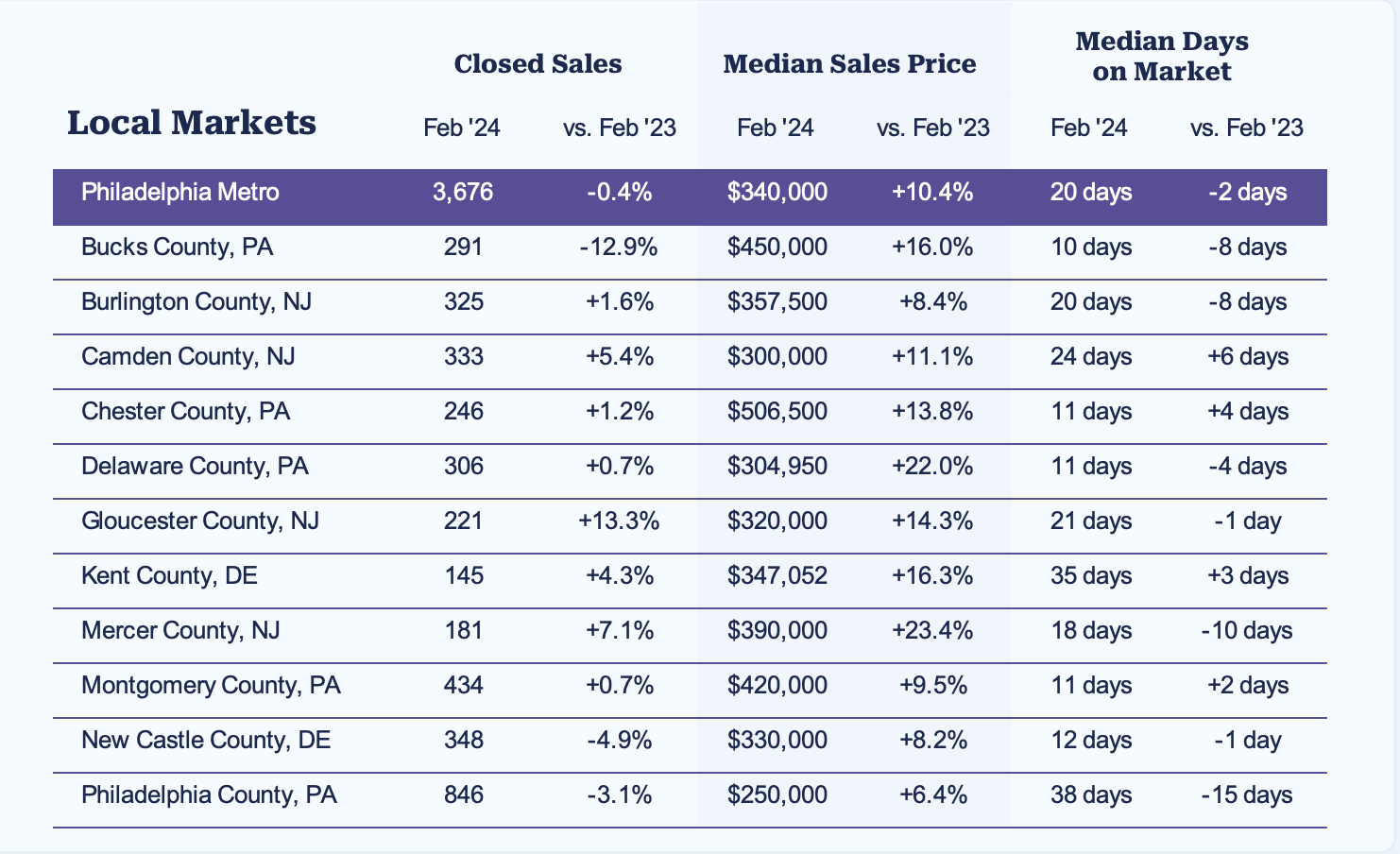

Buyers find a very competitive market in the Philadelphia metro area, despite elevated mortgage rates. In February, the median sold price in the region was $340,000, which was up 10.4% compared to a year ago. This is the fastest pace of home price growth since May 2022.

Low inventory continues to keep home prices rising. While supply is increasing in other markets across the Mid-Atlantic, inventory was basically flat in the Philadelphia metro area in February.

Sales activity is still tracking below last year’s levels. The number of new pending sales was down 2.1% compared to a year ago, which reflects higher mortgage rates in February. However, demand is still strong, and homes are selling quickly in the Philadelphia metro area. In February, half of all homes sold in 20 days or less, and the median days on market is two days faster than a year ago.

Philadelphia Metro Buyers have been frustrated by elevated mortgage rates and low inventory. But there could be relief coming on both fronts. Mortgage rates should fall slightly this spring, though will likely remain above 6% this year. Inventory is expected to increase. New listings are already on the upswing, up 7.2% year-over-year. With more listings, expect more sales this spring.

Let’s take a look at each county individually:

If you are thinking about making a move, and want to know the value of your home contact me. I offer free 30 min in home consultations. 267-397-6291.