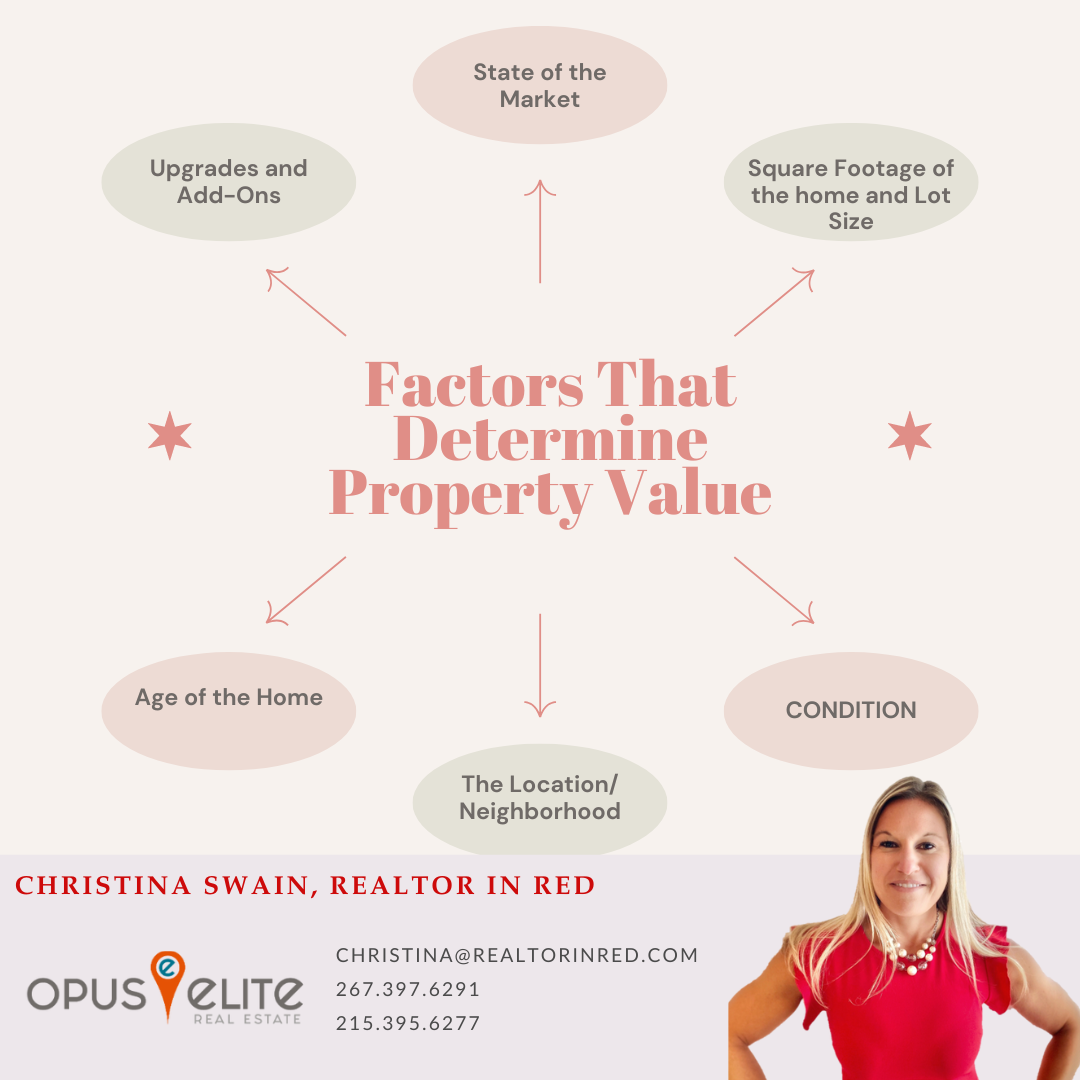

1. Prices of Comparable Properties

Comparable home sales in the area will influence a home’s listing price. How much have similar homes recently sold for in the community? Understanding the value of comparable properties (also known as “comps”) can go a long way in determining home value. The idea is to look at properties that closely match the home in question.

You might start by checking the prices of nearby listings on sites like Zillow and Realtor.com. The downside is that a home’s list price doesn’t always accurately reflect its value—especially in a hot housing market. In this way, a real estate agent might be better equipped to help you. They’ll likely have access to more recent and comparable home sale data.

2. The Neighborhood

The desire to be closer to jobs, schools or public transportation is a primary reason for purchasing a home, according to a recent National Association of Realtors (NAR) report. Other factors that can make a neighborhood appealing enough that they improve a home’s value include:

- Proximity to grocery stores, shopping and entertainment

- Access to public transportation and major highways

- Available parking

- The quality of the local schools

- The crime rate

These factors may influence why buyers are willing to pay much higher prices on some homes than other homes that are just a few miles away.

The neighborhood can also hurt a home’s value if, for instance, it’s close to an airport or a busy thoroughfare. A perfect home on paper may not be so perfect if the location doesn’t fit with a buyer’s lifestyle.

3. The Home’s Age and Condition

Age could bring down a home’s value, especially if the home needs work. Buying a fixer-upper can translate to all kinds of additional costs. There are cosmetic concerns such as an outdated kitchen or a less-than-modern floor plan, and then there are functional issues like problems with the home’s roof or plumbing.

Replacing a roof can run over $7,000, while an HVAC system could set a homeowner back more than $8,000, according to a 2019 remodeling report by NAR. Generally speaking, it also costs more to insure an older home. On average, homeowners insurance premiums are 75% higher for homes that are more than 30 years old.

4. Property Size

It goes without saying that a five-bedroom house will probably cost more than a two-bedroom condo in the same area. The size of the lot the home occupies comes into play as well. Depending on the buyer, a big backyard may be more valuable than an extra bedroom. Overall, the desire for a larger space is the second most popular reason for purchasing a new home, according to NAR data. Looking at home value per square foot can be a helpful way to make apt comparisons of differently sized properties.

5. The State of the Housing Market

The housing market tends to run in cycles, alternating between favoring buyers and sellers. When supply is low, home prices tend to go up—especially if there’s a surge of buyers. Mortgage rates are another important piece of the puzzle, and they vary based on economic conditions and other market factors.

Early in the pandemic, the Federal Reserve cut its target interest rates, which essentially made it cheaper to borrow money. That, paired with limited inventory, drove up home values and set the stage for a seller’s market. The median sales price of new houses sold in January 2020 was $266,300, according to Zillow data, and a year later that number increased to $346,400—a 30% jump. By January 2022, the median sales price had grown to $423,300.

However, things could begin cooling down in the near future. The Federal Reserve is expected to bump up interest rates, though housing inventory is still at a record low, which may keep home prices high.

How to Estimate the Market Value of a Home

To get a general idea of how much a home might be worth, you could use an online home value estimator, which considers recent sales and listing prices to predict a home’s value. These tools are typically offered by popular real estate sites such as Zillow and Trulia.

I am happy to offer a free comparable market analysis as well. Just call me (267) 397-6291.